Communicate & Collaborate with Clients Online

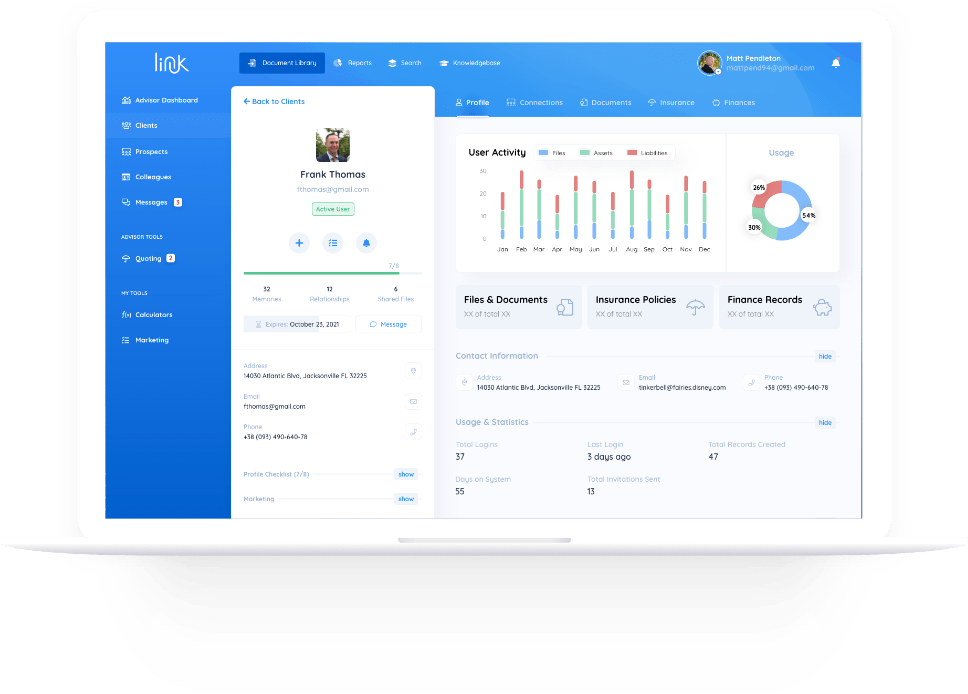

Our digital platform provides advisors with the tools to receive next-generation insight and control over their relationships with their clients and prospects.

The challenges advisors face every day are relics of the past. The advisor of tomorrow has a holistic picture of their client’s financial wellbeing and lifestyle. Those advisors use LegacyShield.

Store and organize client information while enriching the experience with technology.

Clients desire simplicity, security, and greater connectivity. In fact, according to a CNBC study, the majority of today's customers want to connect, share, and conduct business online.

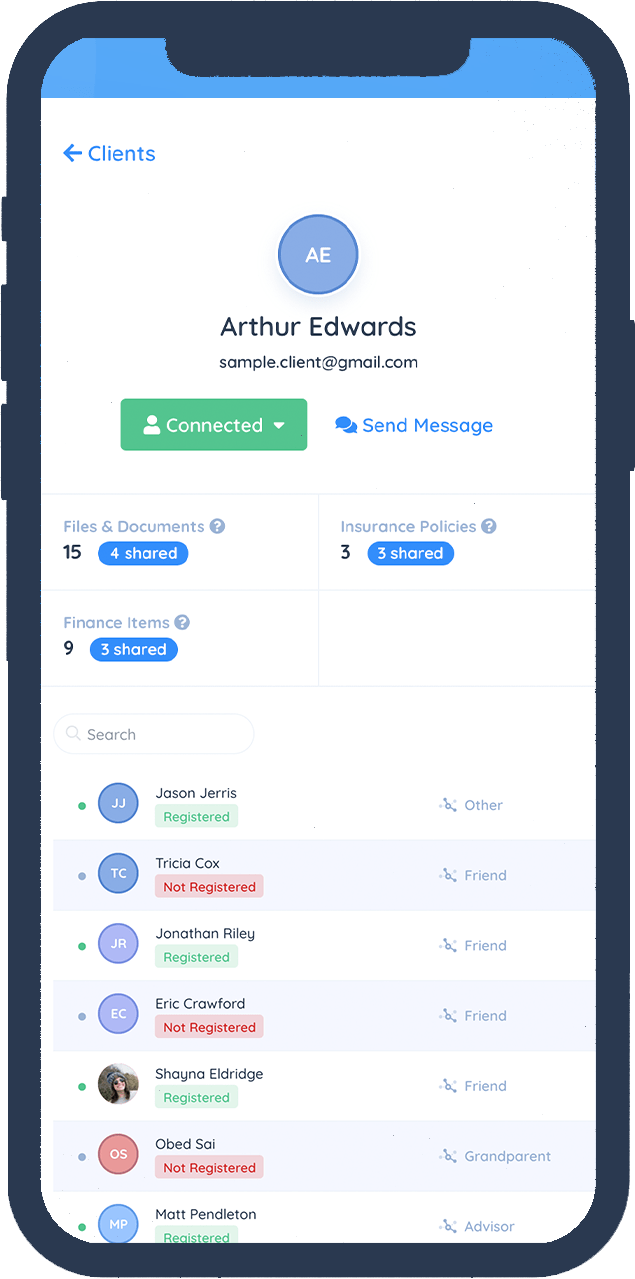

How can I see my client's friends and family connections in LegacyShield?

On the main dashboard, advisors can see each client’s profile along with their connections, records, messages, and the last time a client logged in. Each client account will also display their contacts on their profile.

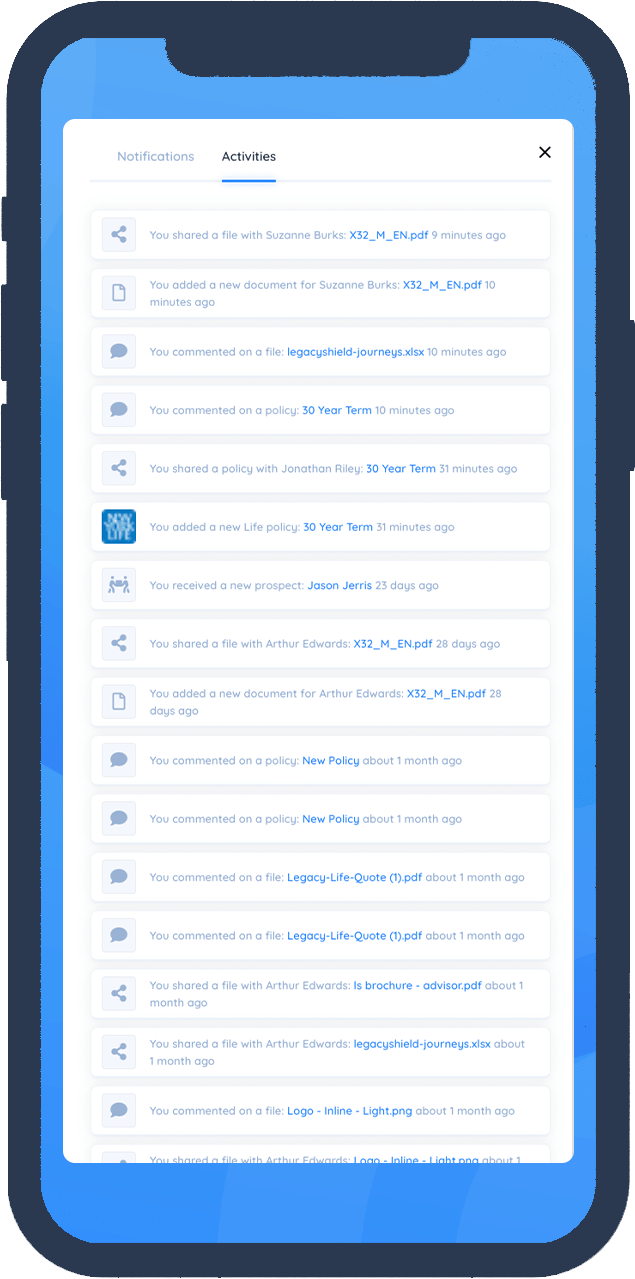

When I sent my client a new policy, can I see if they opened it?

Yes, LegacyShield provides advanced insights by allowing advisors to monitor client activity, including interacting with their policies.

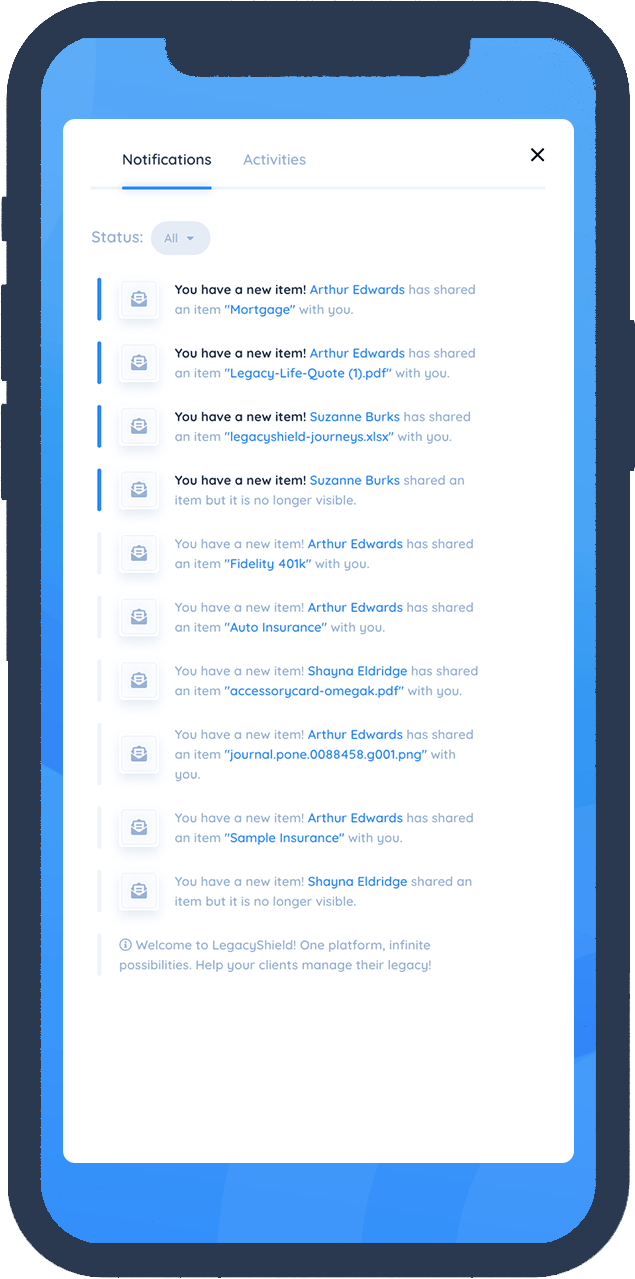

Can I choose how I receive notifications for my client's life events?

Not only are you able to categorize your communication by policy, new application, or existing product, but you are also able to choose when and how to receive notifications on particular events. Clients can share information immediately or at pre-registered life events.

Can I talk to my client's other finance professionals?

While you can send messages and documents to your clients’ other professionals, we recommend discussing that with your client before reaching out. We encourage collaboration among all parties but want to ensure that every party receives consideration.

Are there integrations with my tools like CRMs and quoting?

Yes, LegacyShield integrates with several industry partners, including SmartOffice, Outstand, Estate Guru, and Plaid.

A Unique Platform

There’s nothing else like LegacyShield. We’re connecting the finance professionals with the consumers in a new online experience to collaborate as a partnership.

The Future of Insurance

The world is digital, and insurance is quickly catching up. If you’re still doing insurance the old fashioned way, you’re rapidly falling behind. Let us help you stay on top.

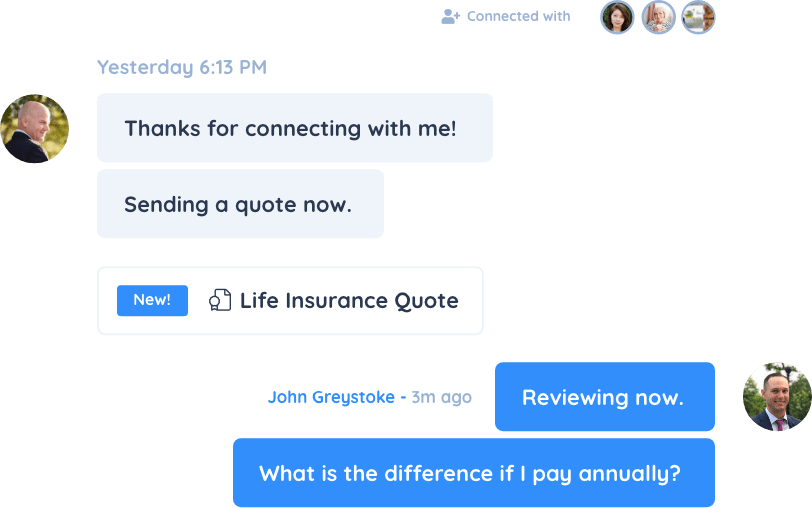

Live Messaging Is The New Standard

We’re serious about communication. The advisor of tomorrow does business where the clients are – online.

- Talk with your clients about life changes as they happen. Discuss significant coverage opportunities and keep the dialogue open.

- Connect with clients on their terms. When they need support or have questions about products, you can be there in an instant.

"As the landscape becomes more competitive, advisors need to go with technologies that enable them to reach people and connect."

Brandon HayesManaging Director, Atlanta-based RIA

Seamless Sharing & Networking

The Benefits of Sharing and Collaborating Online

Do your clients have a solution for sharing their insurance policies and critical information with their loved ones? LegacyShield provides you and your clients with automated document sharing.

- Insurance policies, files, documents, account information, and more can all be shared at any time or automatically by preset life events or dates that you choose, such as death or hospitalization.

- When consumers connect with their friends and family, those connections become your new sales leads.

- Connected members can collaborate on information, which empowers you, the advisor, to connect across multiple generations.

Easy to Use

Complete Control

Totally Online

Well Organized

Completely Secure

Hello. We’re LegacyShield. We make tools that help you collaborate with your clients entirely online.

By giving you and your clients an online platform to work together, all the pieces come together in one place.

You can deliver policies digitally to your client, and they can share those things digitally with their families and other finance professionals – and you’ll have insight into all of that.

You’ll learn about your clients’ families and planning opportunities like marriages, children, big purchases, and other significant life changes that present new insurance coverage opportunities.

Better client connectivity and more frequent communications result in better relationships and increased trust.